Of Mice and Men | The Great Depression

|

John Steinbeck published Of Mice and Men in 1937 during the Great Depression and set the book at the height of this. It was a time of huge economic difficulty in America and around the world. Following the collapse of the New York Wall Street stock market in 1929, the United States entered a period of economic depression.

1 | The Roaring Twentie

The period from 1920 to 1929 is known as the Roaring Twenties – a near-decade of economic growth and prosperity in the United States.

The US economy was thriving and unemployment was down. Businesses and manufacturing industries were expanding and, because they were doing so well, the prices of their shares increased. Many working-class citizens became interested in stock market investments. They purchased shares with the expectation of making more money. It was seen as the new gold rush. The problem was that – because share prices were steadily rising - many people did not have enough money to buy those shares. They had to borrow money to buy them and invest in the stock market. This is a process known as “margin buying”.

The healthy economic climate and the steady growth of share prices made people overconfident and unafraid of debts. It was easy to take out a loan. The market got caught up in a speculative bubble. Shares kept rising, and people felt they would continue to do so.

However, by 1929 many stocks became overvalued. As prices began to drop, investors panicked and tried to leave the market as quickly as possible by selling what they could.

- Henry Ford (and his new mass-production methods) had made gasoline cars affordable for people.

- It also made technology affordable to the middle class. Many had acquired new electric machines that made life easier, such as washing machines and vacuum cleaners.

- The 19th Amendment (1920) extended to right to vote to women.

- The new motion pictures (= movies) enthralled the whole country, and radio brought music into homes.

The US economy was thriving and unemployment was down. Businesses and manufacturing industries were expanding and, because they were doing so well, the prices of their shares increased. Many working-class citizens became interested in stock market investments. They purchased shares with the expectation of making more money. It was seen as the new gold rush. The problem was that – because share prices were steadily rising - many people did not have enough money to buy those shares. They had to borrow money to buy them and invest in the stock market. This is a process known as “margin buying”.

The healthy economic climate and the steady growth of share prices made people overconfident and unafraid of debts. It was easy to take out a loan. The market got caught up in a speculative bubble. Shares kept rising, and people felt they would continue to do so.

However, by 1929 many stocks became overvalued. As prices began to drop, investors panicked and tried to leave the market as quickly as possible by selling what they could.

Contenu reservé aux membres | Member Only ContentConnectez-vous pour lire la suite | Sign in to read more

|

If you are already logged in, please scroll down. | Si vous êtes déjà connecté, veuillez descendre.

|

|

|

2 | The Wall Street Crash in 1929

The crash happened after a long period of rising market growth that led to consumer overconfidence. When experienced investors became aware that the American economy was slowing down, and that shares were over-valued, they began selling them in large numbers. On 24 October, Black Thursday, 12.8 million shares were sold.

Prices plummeted [ chuter / s’effondrer ] and the stock market began to crumble. On 29 October 1929, Black Tuesday, the collapse of the economy was complete. 16 million shares were sold at a fraction of their price. Thousands of people saw their fortune invested in shares, or any money they had in the bank, disappear. Those who had bought “on the margin” were in great trouble. The Roaring Twenties came suddenly to an end.The crash happened after a long period of rising market growth that led to consumer overconfidence. When experienced investors became aware that the American economy was slowing down, and that shares were over-valued, they began selling them in large numbers. On 24 October, Black Thursday, 12.8 million shares were sold.

Prices plummeted [ chuter / s’effondrer ] and the stock market began to crumble. On 29 October 1929, Black Tuesday, the collapse of the economy was complete. 16 million shares were sold at a fraction of their price. Thousands of people saw their fortune invested in shares, or any money they had in the bank, disappear. Those who had bought “on the margin” were in great trouble. The Roaring Twenties came suddenly to an end.

Prices plummeted [ chuter / s’effondrer ] and the stock market began to crumble. On 29 October 1929, Black Tuesday, the collapse of the economy was complete. 16 million shares were sold at a fraction of their price. Thousands of people saw their fortune invested in shares, or any money they had in the bank, disappear. Those who had bought “on the margin” were in great trouble. The Roaring Twenties came suddenly to an end.The crash happened after a long period of rising market growth that led to consumer overconfidence. When experienced investors became aware that the American economy was slowing down, and that shares were over-valued, they began selling them in large numbers. On 24 October, Black Thursday, 12.8 million shares were sold.

Prices plummeted [ chuter / s’effondrer ] and the stock market began to crumble. On 29 October 1929, Black Tuesday, the collapse of the economy was complete. 16 million shares were sold at a fraction of their price. Thousands of people saw their fortune invested in shares, or any money they had in the bank, disappear. Those who had bought “on the margin” were in great trouble. The Roaring Twenties came suddenly to an end.

3| The Effects of the Great Depression

A. The collapse of the economy and loss of confidence in the future

The Wall Street Crash in 1929 led to an unprecented depression in the United States. Many investors and working-class people lost their entire savings. 11,000 banks went bankrupted, with 9 million saving accounts becoming worthless.

The Wall Street Crash in 1929 led to an unprecented depression in the United States. Many investors and working-class people lost their entire savings. 11,000 banks went bankrupted, with 9 million saving accounts becoming worthless.

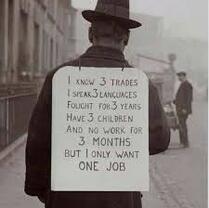

- Unemployment rose to 25 per cent of the national workforce (14 million people).

- People struggled to buy basic goods, such as food and clothing.

- They lost confidence in the economy and hope in the future.

- Suicides went up 50 per cent.

B. Great Misery and Homelessness

- Many people were struggling to pay their mortgage, and approximately 1,000 homes were foreclosed upon every day in 1933.

- Some people slept on park benches. Others deliberately got themselves arrested as it meant food and a bed for the night.

- About 2 million bankrupt farmers and unemployed people became hobos.